Leaders Don’t Guess, They Guide

June 21, 2022

CEOs are giving odds on a recession, and conjuring metaphors for how bad it'll be. My dog Charlie knows better than that.

Three times a week, I write a newsletter called Executive Communication Report (to which you should subscribe, because it is useful, and free). Published under the auspices of the Executive Communication Council, its thrust most days falls under the standing header, “What leaders are saying, and how they’re sounding.”

With increasing frequency over the last three months, most of what “leaders” have been saying is predictions, about whether we’ll have a recession, and how bad that recession could be. A few items we’ve published in ECR lately:

***

April 1

JPMorgan Chase CEO Jamie Dimon said the war in Ukraine might combine with rising inflation to create real economic upheaval, according to the Wall Street Journal. These forces “present completely different circumstances than what we’ve experienced in the past—and their confluence may dramatically increase the risks ahead,” Dimon wrote in his annual shareholder letter, out today. “While it is possible, and hopeful, that all of these events will have peaceful resolutions, we should prepare for the potential negative outcomes.”

April 15

JPMorgan Chase CEO Jamie Dimon told reporters Wednesday he sees economic “storm clouds on the horizon that may disappear, they may not,” Yahoo Finance reports. Citing the war in Ukraine, inflation and the Federal Reserve’s hawkish monetary policy, Dimon said: “Those are very powerful forces, and those things are going to collide at one point. No one knows what’s going to turn out.” Asked whether a recession is possible, Dimon said, “Absolutely.” Yahoo Finance noted that Dimon’s comments are in stark contrast to what he said a year ago in his annual letter to shareholders, predicting an economic “Goldilocks moment,” coming from a large anticipated increase in public spending. “It’s a lot of money, and it’s bound to cause a booming economy,” Dimon said then.

May 18

Wells Fargo CEO Charlie Scharf said this week “it’s going to be hard to avoid some kind of recession,” Fox Business reports. On the upside, Scharf, speaking at a Wall Street Live event, also said, “The fact that everyone is so strong going into this should hopefully provide a cushion such that whatever recession there is, if there is one, is short and not all that deep.”

May 23

Qatar Investment Authority CEO Mansoor Al Mahmoud said he is “less pessimistic” about a looming global recession, according to CNBC. “The sell-off that we see [is] embedded in all of the bad scenarios that we are talking about. So we’re talking about recession, inflation and geopolitical issues,” Al Mahmoud said in an interview over the weekend in Davos. However, he added: “We are in better shape in terms of the banking sector that has a good balance sheet, we have good liquidity. I’m not saying that we will not have a slowdown, I’m not saying that we might not have a recession, but if we have a recession, it will be a light recession.”

May 25

“Consumers are in good shape, not over-leveraged,” Bank of America CEO Brian Moynihan told CNBC from Davos yesterday. Moynihan noted that the checking and savings accounts of the bank’s customers are larger than they were before the pandemic, and they’re spending 10% more this month than they were a year ago. “What’s going to slow them down? Nothing right now,” Moynihan said.

June 3

JPMorganChase CEO Jamie Dimon warned Wednesday of a coming “economic hurricane,” telling participants at an economics conference Wednesday, “Right now, it’s kind of sunny, things are doing fine. Everyone thinks the Fed can handle this. That hurricane is right out there down the road, coming our way. We just don’t know if it’s a minor one or Superstorm Sandy or Andrew or something like that, and you better brace yourself.”

PNC Financial Services Group CEO Bill Demchak also said the U.S. economy is headed for a recession, but said the storm will be mild, according to the Pittsburgh Post-Gazette. “I don’t see any possible outcome other than recession. We’re gonna have a slow down for a period of time. We have to get inflation right.” But he added, “I don’t think it’s going to be a hurricane. We are going to get inflation under control. I think rates will be higher than people assume and I think we will come out of it just fine. Frankly, I think we are going to have a big rip back.”

June 8

World Bank President David Malpass issued a report warning of a recession, or worse, Fortune reports. “Just over two years after COVID-19 caused the deepest global recession since World War II, the world economy is again in danger… For many countries, recession will be hard to avoid.” He continued: “Several years of above-average inflation and below-average growth are now likely, with potentially destabilizing consequences for low- and middle-income economies. It’s a phenomenon—stagflation—that the world has not seen since the 1970s.”

June 15

Morgan Stanley CEO James Gorman told CNBC the odds of a recession are a coinflip. “It’s possible we go into recession, obviously, probably 50-50 odds now,” Gorman said Monday at a Morgan Stanley financial conference. Gorman, who had earlier given recession odds at 30%, added, “we’re unlikely at this stage to go into a deep or long recession.”

***

Really? We need the head of a giant bank to tell us the odds of recession are 50-50 now? My springer spaniel Charlie has won Chicago’s Dumbest Dog three years in a row, and his guess is as good as that. (And as he points out here, he wasn’t dumb enough to offer 30% odds in the first place.)

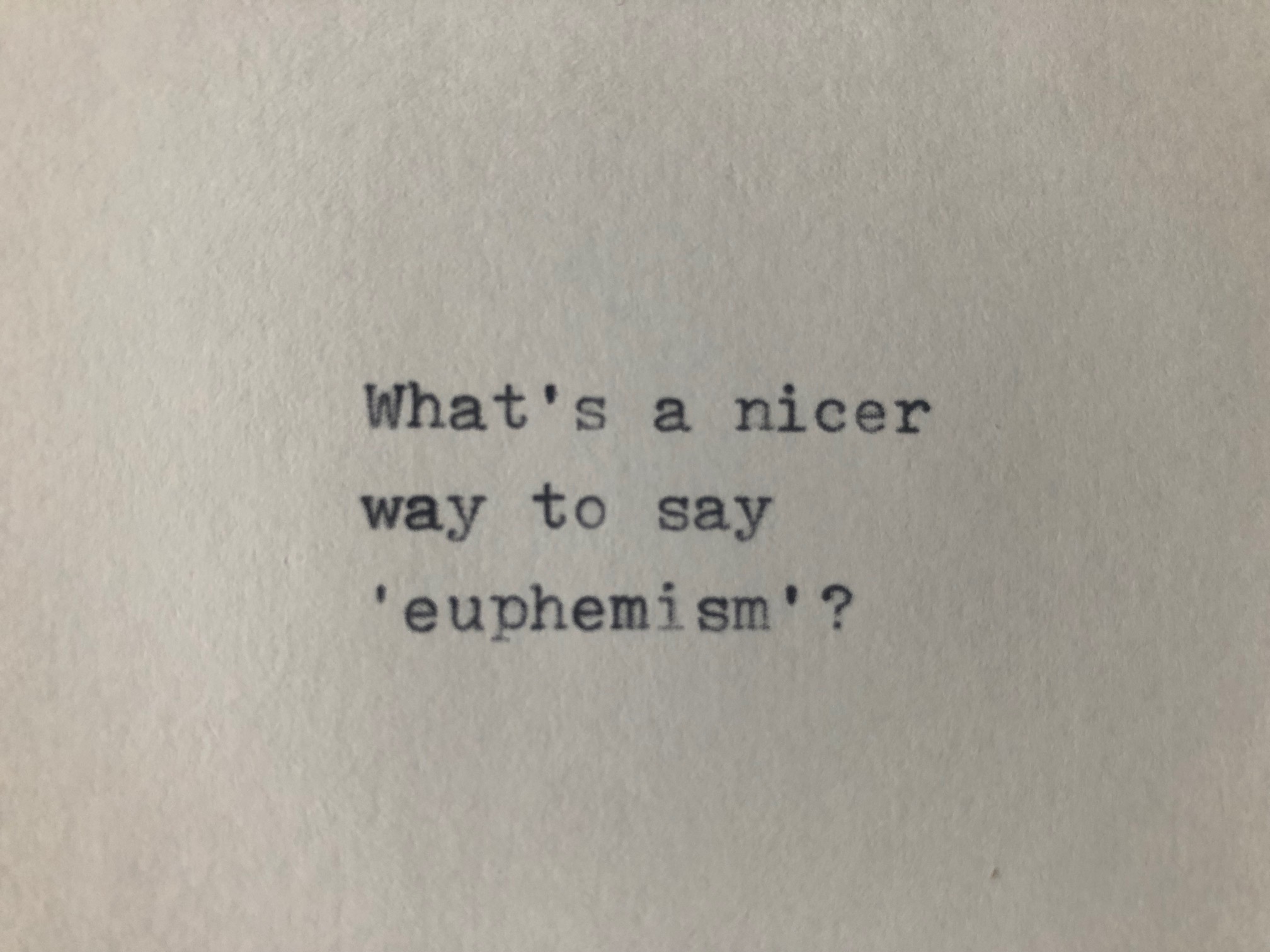

I’ve leaned hard here over the years on Kurt Vonnegut’s quote, “Persuasive guessing has been at the core of leadership for so long—for all of human experience so far—that it is wholly unsurprising that most of the leaders of this planet, in spite of all the information that is suddenly ours, want the guessing to go on because it is now their turn to guess and be listened to.”

Which is why a CEO can distinguish herself or himself by declining to guess, by explicitly admitting: It’s impossible to predict the future of the global economy, no matter how fancy your cuff links. And a CEO can build credibility by telling us how they’re trying to manage their organization over the long haul.

An undelivered section of LBJ’s famous 1964 commencement speech at the University of Michigan, written by speechwriter Dick Goodwin, is about the U.S. presidency, but it applies to all large leadership jobs: “The presidency is a relentless place. It is beset by the clamor of current crisis, the insistence of immediate issues, the demands of developing danger. To steer the nation through momentary pressure toward fixed purpose is one of the highest duties of my office. … [A president] must sense amid the welter of events and prophecies the shape of things to come. He must look beyond impending hazard to widening horizons, beyond today to tomorrow. And he must set his course so that, in decades to come, Americans will be the masters and not the victims of their times.”

Where, pray tell, does public guessing fit into that responsibility?

I can’t believe it falls to me to explain this to people who make eight figures and more, but here we are: Don’t be guessing, be guiding.

Postscript: And as I’m drafting this post, I see a Politico story in which a number of anonymous second-guessing CEOs criticize Fed Chairman Jerome Powell for guessing wrong a year ago:

Said a senior executive at another large Wall Street bank: “A lot of what happened, at least this year, was unknowable and they had to somehow try and balance things perfectly, and that’s just an impossible task. But the way many executives see it, there were other opportunities to move earlier and be in a better position right now, and obviously Powell and the Fed just did not get it right.”

Couldn’t you just thank God for leadership like that?